Achieving Long-term Success

본문

Budgeting is often the first step towards achieving financial stability, as it allows individuals to understand where their money is being spent and make informed decisions about how to allocate it. By tracking income and expenses, individuals can identify areas where they can cut back on unnecessary spending and allocate those funds towards more important goals. For example, cutting back on dining out or subscription services can free up hundreds of dollars each month, which can then be put towards saving for a down payment on a house or paying off high-interest credit card debt.

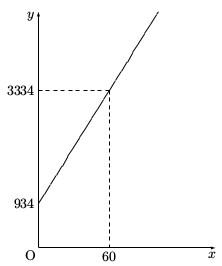

Financial planning, on the other hand, is a more detailed and long-term strategy that involves setting specific financial targets, such as saving for a specific emergency fund. A comprehensive financial plan takes into account an individual's income, expenses, debts, assets and aspirations to create a roadmap for achieving financial stability. It also involves managing investments, managing risk and developing strategies for generating passive income.

For many people, financial planning means creating a "firewall" that provides protection against unexpected expenses or job loss. This can be achieved by building an emergency fund, which covers 3-6 months of living expenses. It may also involve purchasing insurance coverage, such as life, disability or long-term care insurance, to protect against financial losses.

Creating a budget and financial plan is not a one-time task but an ongoing process. As financial situations change, budgets and plans need to be adjusted accordingly. Many people automatically adjust their budget every few months to ensure they are staying on track and making progress towards their financial aspirations. This includes monitoring expenses, updating income and making adjustments to financial strategies as needed.

While budgeting and financial planning can seem intimidating to novice users, it is an important step towards achieving financial stability and security. By breaking down the process into smaller, manageable steps and tracking progress along the way, individuals can develop a clear picture of their financial situation and make informed decisions about their financial future.

Furthermore, budgeting and financial planning can help prevent financial pitfalls such as debt accumulation and financial stress. Many people have fallen into debt due to overspending or failing to plan for expenses. By creating a budget and tracking expenses, individuals can identify areas where they are overspending and make adjustments before it is too late. This can help prevent debt accumulation and ensure that financial goals are met.

Finally, budgeting and financial planning can also help individuals achieve financial freedom and ソフト闇金 independence. By creating a comprehensive financial plan and sticking to it, individuals can accumulate wealth over time and achieve financial freedom. This can provide peace of mind and a sense of security, knowing that they are prepared for any financial situation that may arise.

In conclusion, creating a budget and financial plan is an essential step towards achieving financial stability and security. By breaking down the process into smaller, manageable steps, tracking progress and making adjustments as needed, individuals can develop a clear picture of their financial situation and make informed decisions about their financial future. With patience and discipline, budgeting and financial planning can help individuals achieve their financial aspirations and achieve financial freedom.

댓글목록0

댓글 포인트 안내